July

2014

July 2, 2014

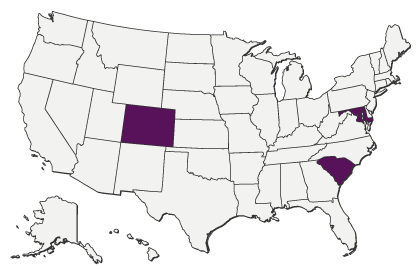

Colorado, Maryland & South Carolina: Creative Economy 2014 State Legislation Roundup

Creative Economy 2014 State Legislation Roundup

State policymakers are increasingly eager to harness the power of the creative economy for the benefit of their citizens. Cultural districts, in particular, are a popular policy measure with state lawmakers as they foster both commerce and quality of life in home districts. In addition, cultural districts are primed to become state or even national destinations, a potential point of pride for any lawmaker. (For more information on the policies, strategies, management practices and trends of cultural district programs, see NASAA’s State Cultural Districts Policy Brief and its State Cultural Districts Strategy Sampler.)

In the 2014 legislative session, three states enacted legislation manifesting lawmakers’ and governors’ interest in cultural districts as part of the creative economy. Colorado and Maryland adopted policies growing the benefits of their active cultural district programs, while South Carolina lawmakers, with the support of the South Carolina Arts Commission, established the state’s first cultural district policy. Following is a brief summary of these new laws.

States that Enacted Cultural District Legislation in 2014

Colorado H.B. 14-1093 (enacted)

This new law creates and finances the Colorado Creative District Community Loan Fund and authorizes the Colorado Creative Industries Division to make loans and loan guarantees from it to support the growth of the creative districts it certifies. The Division may loan up to $250,000 per project for infrastructure upgrades and the development or redevelopment of commercial real estate, mixed-use projects, or community facilities within a state-certified district or district that is a candidate for certification. Loans must be matched at least three to one with cash or in-kind contributions. Each year, up to 8% of the fund may be dedicated to administrative costs the Division incurs while running the program. Though the loan fund’s principal consists of money appropriated to it by the legislature, it is designed to grow from the seeds of matching moneys and reinvestment. The Division has entered into a memorandum of understanding with the Mile High Community Loan Fund (MHCLF) to assist with the implementation of the new fund’s policies, procedures and loan product terms, and MHCLF has made up to $4.5 million available to leverage the Division’s funds. For more information about the Creative District Community Loan Fund, contact Colorado Creative Industries Division Public Art & Creative District Manager Deana Miller.

South Carolina S. 1172 (enacted)

Enacted in June, this law directs the South Carolina Arts Commission (SCAC) to develop the statewide policy criteria and guidelines for designating cultural districts. The legislature defines cultural districts as geographic concentrations of cultural facilities, creative enterprises or other arts venues through which communities encourage cultural and economic development, preservation and reuse of historic buildings, and the cultivation of a unique local identity. The Commission, in accordance with the new statute, will help communities establish cultural districts, will pursue partnerships with other public agencies and the private sector in support of them, and will establish a process to evaluate and periodically recertify previously designated districts. To learn more, contact SCAC Executive Director Ken May and Senior Manager for Program Development Rusty Sox.

Maryland H.B. 1516 (enacted)

This revision to Maryland’s Arts and Entertainment (A&E) District statute expands the eligibility of the state’s artists to qualify for the income tax incentive available through the Maryland State Arts Council‘s (MSAC) Arts & Entertainment District program. Previously, only artists who created and sold work within a single designated district and who resided within the county where the district was located qualified for the incentive. Now, an artist living anywhere in the state who creates art in any of Maryland’s 22 designated A&E Districts and sells it in any of the Districts is eligible for the incentive. Qualifying artists pay no state income tax on the proceeds from the sale of their artwork. This includes performing artists who receive compensation for performances in A&E Districts. The law aims to foster artistic entrepreneurship across the state and to encourage commerce, cultural exchange and revitalization efforts in each Arts & Entertainment District. Find out more from MSAC Program Director Pamela Dunne.

In this Issue

State to State

Legislative Update

More Notes from NASAA

Executive Director's Column

Research on Demand

SubscribeSubscribe

×

To receive information regarding updates to our newslettter. Please fill out the form below.