March

2018

March 7, 2018

NASAA News and Current Information

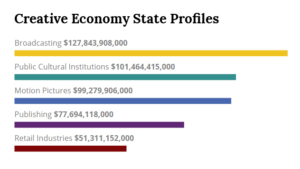

NASAA’s New Creative Economy State Profiles

Creative Economy State Profiles is a new NASAA tool that enables state level explorations of the economic impact of the arts. The interactive dashboard, produced in cooperation with the National Endowment for the Arts, uses fresh data drawn from the Arts and Cultural Production Satellite Account published by the U.S. Bureau of Economic Analysis, including data on the contribution of the arts as a percentage of gross state product. The dashboard is designed to help state arts leaders quantify the contributions of the arts and culture in their state.

Creative Economy State Profiles is a new NASAA tool that enables state level explorations of the economic impact of the arts. The interactive dashboard, produced in cooperation with the National Endowment for the Arts, uses fresh data drawn from the Arts and Cultural Production Satellite Account published by the U.S. Bureau of Economic Analysis, including data on the contribution of the arts as a percentage of gross state product. The dashboard is designed to help state arts leaders quantify the contributions of the arts and culture in their state.

Arts Advocacy Videos You Can Share

NASAA has just released four short videos supporting the benefits of the arts to American communities. We hope you will share them on your social media channels, in your newsletter and on your website to encourage action:

NASAA has just released four short videos supporting the benefits of the arts to American communities. We hope you will share them on your social media channels, in your newsletter and on your website to encourage action:

American Ingenuity

Art Heals

Student Success

Art in Our Everyday Lives

Find all four videos on our Act Now! page.

Your Support Matters!

When you give to NASAA, you support the most influential, credible and strategic advocacy—everything from protecting the National Endowment for the Arts (NEA), to making your voice heard on Capitol Hill and helping you make a compelling, customized case in your state. NASAA can’t use dues or NEA funding to support our advocacy work, which makes gifts from individuals so special. We can’t do it without you! Please give today—your generous support empowers NASAA to fight year-round for you and for all state arts agencies. Thank you!

New Data Demonstrating the Public Value of Museums

Two new reports from the American Alliance of Museums (AAM) document data demonstrating the public value of cultural institutions in the United States. In Museums as Economic Engines, AAM measures the substantial economic impact of the museum sector. Museums in the United States, for example, collectively support 726,000 jobs and directly employ 372,100 people, which is more than double that of the professional athletics industry. Furthermore, they annually generate more than $12 billion in federal, state and local tax revenue and contribute about $50 billion to the national economy. AAM’s Museums & Public Opinion, meanwhile, shows that citizens across the country recognize the cultural and economic value of museums. According to the report, which is based on a survey of more than 2,000 people, 97% of respondents believe that museums are educational assets for their communities and 89% see them as economic drivers. In addition, 96% support level or increased federal funding for museums and 96% would welcome legislators taking action to support museums.

Two new reports from the American Alliance of Museums (AAM) document data demonstrating the public value of cultural institutions in the United States. In Museums as Economic Engines, AAM measures the substantial economic impact of the museum sector. Museums in the United States, for example, collectively support 726,000 jobs and directly employ 372,100 people, which is more than double that of the professional athletics industry. Furthermore, they annually generate more than $12 billion in federal, state and local tax revenue and contribute about $50 billion to the national economy. AAM’s Museums & Public Opinion, meanwhile, shows that citizens across the country recognize the cultural and economic value of museums. According to the report, which is based on a survey of more than 2,000 people, 97% of respondents believe that museums are educational assets for their communities and 89% see them as economic drivers. In addition, 96% support level or increased federal funding for museums and 96% would welcome legislators taking action to support museums.

GIA Reflection on Three Decades of Arts Funding Research

In recognition of the 25th anniversary of the publication of its first study of arts funding, Grantmakers in the Arts (GIA) has published a reflection on how arts and culture funding has evolved between the 1980s and today. Arts Funding at Twenty-Five not only identifies the catalysts for changes in the funding environment—such as economic booms and busts, political controversies, and unprecedented growth in private support—but also recaps insights from prior arts funding research. The report draws on GIA studies, articles published in the GIA Reader, and data, analysis and commentary from other sources.

How States Use Data to Inform Decisions

The Pew Charitable Trusts has released the first comprehensive review of data practices in state government. How States Use Data to Inform Decisions is based on interviews with 350 state officials—who collectively represent all 50 states—as well as a review of states’ policies related to data collection, analysis and usage. Citing individual state examples and analyzing trends across states, the report details how current data can be used for program analysis and evaluation, how states can integrate data systems to effectively serve constituents, and the challenges agencies face in collecting, maintaining and analyzing relevant data. The report includes a plan on how to manage and use data at an agency level.

The Pew Charitable Trusts has released the first comprehensive review of data practices in state government. How States Use Data to Inform Decisions is based on interviews with 350 state officials—who collectively represent all 50 states—as well as a review of states’ policies related to data collection, analysis and usage. Citing individual state examples and analyzing trends across states, the report details how current data can be used for program analysis and evaluation, how states can integrate data systems to effectively serve constituents, and the challenges agencies face in collecting, maintaining and analyzing relevant data. The report includes a plan on how to manage and use data at an agency level.

How Federal Tax Changes May Impact States

A new resource from the National Conference of State Legislatures (NCSL) may be helpful to state policymakers as they prepare for implementation of the recently enacted federal tax code overhaul. Federal Tax Reform and the States documents how, in general terms, the tax reforms may impact state revenues, operating budgets and taxation practices in years to come. About one-third of total state government funding comes from federal grants. In addition, most state tax codes conform to some degree with the federal tax code.

In this Issue

From the President and CEO

State to State

- Kansas: Arts in Medicine Partnership

- D.C.: Curatorial Grant Program

- Illinois: Arts and Foreign Language Education Grant

Legislative Update

Announcements and Resources

More Notes from NASAA

Research on Demand

SubscribeSubscribe

×

To receive information regarding updates to our newslettter. Please fill out the form below.