July

2020

July 7, 2020

From the Research Team

Dedicated Revenue Strategies

NASAA’s updated Dedicated Revenue Strategies State Policy Brief shows how states use a variety of funding sources to support the arts. Dedicated revenue for state arts agencies (SAAs) can come from special taxes, gaming taxes and fees, license plate purchases, tax checkoffs, bonds, and cultural trusts. This update uses SAA FY2020 data to report dedicated funding sources before COVID-19 began to affect state government budgets. Uncertainty around SAA FY2021 and 2022 budgets remains, and this report will be important in understanding where dedicated funds stood before the pandemic—and will allow NASAA and SAAs to monitor future trends.

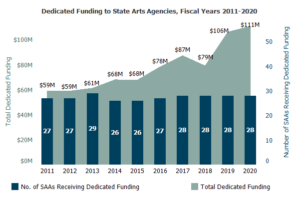

Particularly in times of economic distress, dedicated funding mechanisms can be a popular idea to maintain support for the arts with increasing state budget constraints. Although dedicated revenues increased over the past decade, state general funds still comprise a median 74% of all state funding going to SAAs. The accompanying graph shows dedicated revenue funding trends over the past 10 years. Dedicated funding provides a median 43% of total state funding for the 28 agencies that receive dedicated funds. The brief provides policy considerations and advice for SAAs that are considering a special funding initiative.

The policy brief is part of a series of resources on dedicated revenue. For more detailed information by state, see these NASAA resources on special taxes, arts license plates and tax checkoffs. Contact NASAA Research Manager Patricia Mullaney-Loss with any questions on dedicated revenue initiatives or requests for customized revenue reports for your state.

In this Issue

From the President and CEO

State to State

- Connecticut: Artists Respond Grant Program

- South Dakota: Residencies for Recovery

- Idaho, Oregon, Washington: Creative Borrowing Webinar

Legislative Update

The Research Digest

Announcements and Resources

More Notes from NASAA

SubscribeSubscribe

×

To receive information regarding updates to our newslettter. Please fill out the form below.