September

2018

September 11, 2018

State Arts Agency Dedicated Revenue Strategies

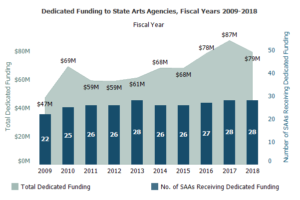

NASAA’s State Policy Brief on Dedicated Revenue Strategies shows how states use a variety of funding sources to support the arts. Dedicated revenue for state arts agencies can come from special taxes, gaming taxes and fees, license plate purchases, tax checkoffs, bonds and cultural trusts. Although dedicated revenues increased over the past decade, state general funds still comprise a median 77.1% of all state arts agency revenue. The accompanying graph shows dedicated revenue funding trends over the past 10 years. Dedicated funding provides a median 32.6% of total state funding for the 28 agencies that receive dedicated funds. The brief provides policy considerations and advice for state arts agencies considering a special funding initiative.

NASAA’s State Policy Brief on Dedicated Revenue Strategies shows how states use a variety of funding sources to support the arts. Dedicated revenue for state arts agencies can come from special taxes, gaming taxes and fees, license plate purchases, tax checkoffs, bonds and cultural trusts. Although dedicated revenues increased over the past decade, state general funds still comprise a median 77.1% of all state arts agency revenue. The accompanying graph shows dedicated revenue funding trends over the past 10 years. Dedicated funding provides a median 32.6% of total state funding for the 28 agencies that receive dedicated funds. The brief provides policy considerations and advice for state arts agencies considering a special funding initiative.

The policy brief is part of a series of resources on dedicated revenue. For more detailed information by state, see our resources on special taxes, arts license plates and tax checkoffs. A new resource on lottery and gaming taxes provides a look at SAAs receiving a portion of revenue generated from casinos, electronic gaming, lotteries and other gaming activities.

Contact Patricia Mullaney-Loss with any questions on dedicated revenue initiatives or requests for customized revenue reports for your state.

In this Issue

From the President and CEO

State to State

Legislative Update

Announcements and Resources

More Notes from NASAA

Research on Demand

SubscribeSubscribe

×

To receive information regarding updates to our newslettter. Please fill out the form below.